Micron Technology Analysis: AI Dominance, Memory Evolution, and the Future of Global Industry

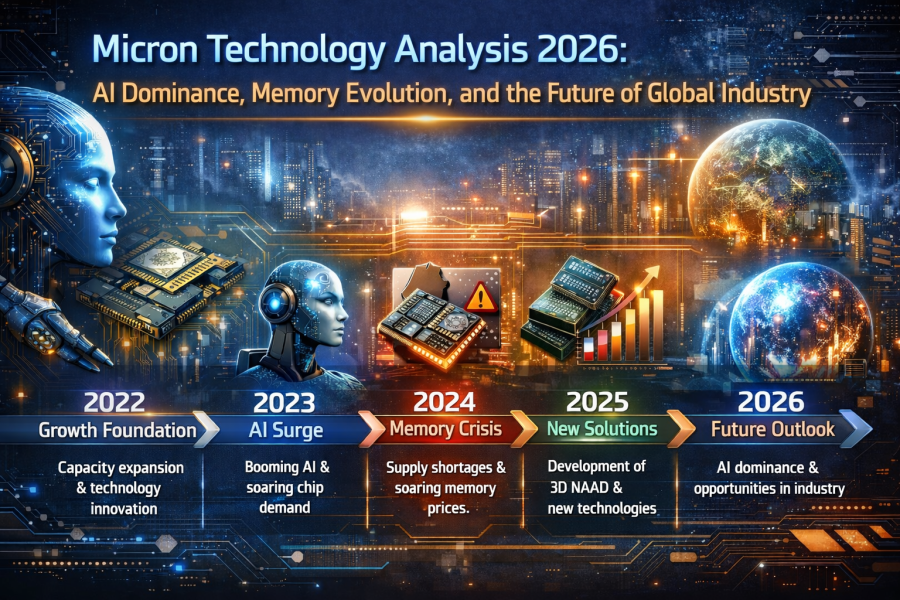

The semiconductor landscape is currently standing at a crucial turning point. Micron Technology (MU) has solidified its position as a central pillar of global innovation. As a key player in the industry, Micron is no longer just producing hardware; it has become the essential foundation of the ongoing Artificial Intelligence (AI) revolution. This article provides a deep dive into the latest industrial trends, stock performance, and the strategic roadmap facing Micron.

See Also : Silver Price Volatility in 2026: Key Drivers, Global Trends dan What It Means for Investors

Strategic Market Positioning and Industrial Demand Dynamics

Current market data indicates that Micron is navigating a period of unprecedented demand. The surge in requirements for High-Bandwidth Memory (HBM) to support AI infrastructure has absorbed a significant portion of the company’s production capacity. This high demand is no longer confined to enterprise data centers; it has begun to influence the broader consumer market, impacting the availability and pricing of RAM for PCs and next-generation smartphones.

To meet this global need, Micron is aggressively expanding its footprint. While new manufacturing facilities are being developed in New York and Idaho, the company is optimizing its current output to ensure the stability of the global tech supply chain.

HBM4 Dominance and Strategic Partnership with NVIDIA

A primary catalyst for Micron’s market leadership is its technological edge in the HBM sector. Micron’s production roadmap shows that its HBM capacity is being rapidly claimed by major cloud service providers and AI developers.

The company is currently focused on the transition to HBM4. This next-generation memory architecture is specifically designed to work in synergy with the latest AI GPUs, offering significant improvements in power efficiency and data capacity compared to previous standards. This technical advantage provides Micron with immense bargaining power among tech giants such as Google, Microsoft, and OpenAI.

Global Expansion: Strategic Investments and the New York Megafab

To address the long-term growth of the digital economy, Micron is executing massive infrastructure projects across multiple continents:

- Asia-Pacific Integration: Micron continues to invest in advanced fabrication sites in Taiwan and Japan to accelerate the production of next-generation DRAM.

- The New York Megafab: The massive facility in Syracuse, New York, represents a historic investment in domestic semiconductor manufacturing. This project is projected to be one of the largest manufacturing centers in the United States, aiming to secure a resilient supply of memory chips for the Western market.

The Strategic Importance of Silver: Foundations of Technology and Energy

The semiconductor industry is inextricably linked to critical raw materials. Silver is no longer viewed merely as a precious metal; it is now recognized as a vital "technology metal" essential for future industrial growth.

The Role of Silver in Semiconductors and AI

Silver possesses the highest electrical conductivity of all metals. In the production of advanced chips and AI infrastructure where energy efficiency is paramount the use of silver in conductive components is vital. The stability of the silver supply chain is now a key factor in maintaining the production pace of high-end semiconductors.

Renewable Energy and Global Healthcare

Beyond computing, silver is a primary component in solar panel technology. As global demand for clean energy grows, silver usage in the energy sector continues to hit record highs. Furthermore, in healthcare, silver’s unique properties are utilized in advanced medical devices and sanitation systems, making it one of the most strategic commodities of the modern era.

Stock Market Analysis: Growth Potential and Valuation

Despite significant price appreciation over the past year, many analysts believe Micron’s valuation remains attractive relative to its growth trajectory. The company’s Forward P/E Ratio often trades at a discount compared to other high-growth AI peers, suggesting further room for upside.

Key financial indicators for the company include:

- Growth Catalysts: Continued adoption of AI-ready PCs and the expansion of 5G/6G infrastructure.

- Analyst Consensus: Major financial institutions maintain "Buy" or "Strong Buy" ratings based on Micron's leadership in HBM.

- Cash Flow Management: Strong free cash flow allows the company to balance aggressive R&D spending with shareholder-friendly capital returns.

Key Challenges: Industry Cycles and Geopolitical Risks

Investing in the semiconductor sector involves navigating inherent risks. The memory industry is historically cyclical; periods of high demand are often followed by capacity adjustments. Furthermore, global trade dynamics and export policies remain critical variables that can influence Micron's international revenue streams.

Conclusion: A Bright Future on a Foundation of Memory

Micron Technology has proven itself to be the backbone of the digital revolution. With its leadership in HBM technology and its massive global factory expansions, the company is perfectly positioned to lead the AI era. For investors and industry observers, the synergy between advanced memory technology and strategic raw materials like silver will be the defining theme of the coming years.

References:

- Micron Investor Relations: Annual and Quarterly Financial Reports.

- Global Semiconductor Alliance (GSA): Market Trends and Production Forecasts.

- TrendForce Analysis: Global DRAM and Flash Memory Market Outlook.

- Tech News Global: Reports on Next-Generation Memory Architecture (HBM4).

- Trading Economics: Industrial Commodity Demand and Silver Price Analysis.

![]()

![]()

![]()